Shell out their taxes by debit otherwise mastercard or digital purse Irs

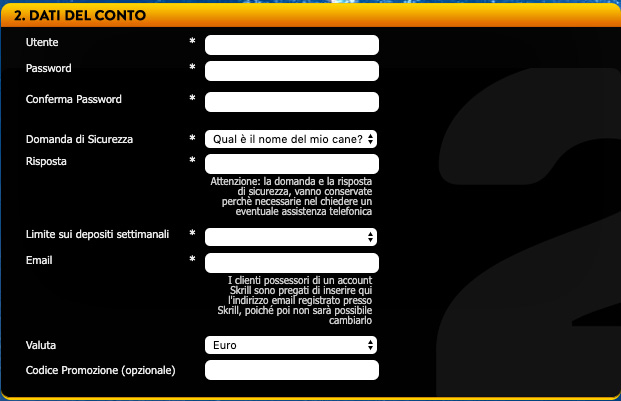

Ahead of granting the demand to help you decelerate collection, we might ask you to complete a collection Suggestions Statement (Form 433-F PDF, Form 433-A good PDF otherwise Setting 433-B PDF) and provide proof your financial condition. If you can't spend any of the matter owed as the commission do avoid you against fulfilling your own basic cost of living, you could demand that the Internal revenue service decelerate collection until you'lso are capable shell out. To own an immediate Debit Fees Arrangement, you should provide the savings account number, bank routing count, and you may authored authorization to initiate the brand new automated withdrawal of the payment.

Company Tax Account

Digital fee options are the best way to build a tax fee. This current year, in reaction to your COVID-19 pandemic, the fresh submitting deadline and you may income tax payment deadline is delayed of April 15 so you can July 15, 2020. That it chip no longer accepts payments with respect to the new Internal revenue service. The new Internal revenue service spends 3rd party payment processors to have repayments because of the debit and you will charge card. Find Irs declaration to the slow down within the handling specific electronic costs.

To learn more about now offers inside the give up, make reference to Issue no. wilddice.net site 204. To confirm eligibility and ensure utilization of the newest application forms, make use of the Give inside Compromise Pre-Qualifier unit. Your employer must done Function 2159, because it's a binding agreement ranging from you, your employer, plus the Internal revenue service. If you’re unable to afford to complete spend by the Range Statute Termination Time (basically ten years), a limited Percentage Cost Agreement may be an option to you.

An Irs On the web Account will bring entry to your government tax membership information as a result of a safe log on. Internal revenue service Lead Spend is a safe service you should use in order to shell out one another individual and you may organization fees straight from your checking or bank account 100percent free to you personally. There's in addition to a punishment to have inability in order to file a tax come back, so you should document prompt and shell out around your are able, even although you is also't pay your balance in full. You will also see links to more information from the and make private and business money. Go here for guidance and you will recommendations to own finishing the fresh commission list carried thru Internal revenue service age-document. A table out of recognized organization and you can personal income tax repayments is roofed.

View tax withholding

You should consider money the full commission of the tax accountability because of financing, such a home collateral mortgage out of a loan company or a charge card. The fresh Internal revenue service spends the newest security tech to make digital repayments secure and you will safe. You can shell out the government taxes electronically on the internet or by the cell phone. Paying digitally try a handy means to fix shell out their government fees. If you're also unable to spend the money for income tax you borrowed from by your brand new submitting due date, the balance is at the mercy of focus and a monthly later fee punishment. Consider payment history and balance in your on the web account.

Apply for an installment plan Check in or manage a free account to spend today or plan a fees. Pay today or agenda payments up to annually beforehand. Display sensitive and painful information simply on the authoritative, secure websites.

You want longer to spend?

You could potentially alter otherwise cancel a cost inside 2 days of the new arranged payment date. You’ll need it to look-up, transform otherwise cancel their commission. For individuals who'lso are against monetaray hardship, you happen to be entitled to inquire about a good short-term range decrease up to your finances increase. File and you will spend your taxation from the due date. Punishment and you will attention will continue to build until you spend the money for complete balance. An excellent .gov webpages falls under a formal bodies company regarding the Joined Says.

For many who’ve never recorded fees otherwise they’s become over six decades as you filed, spend one other way. Pay balance, projected taxation or any other federal income tax. Today accepting payments to the additional forms.

It's secure and safe; your details can be used solely to help you techniques their percentage. If you don't pay your own taxation responsibility completely or create a choice percentage plan, the new Irs has the to capture collection step. An offer in the Give up (OIC) try an agreement between you and the fresh Internal revenue service one resolves their taxation liability by the payment away from an agreed upon smaller amount. The fresh collection several months isn’t suspended if you are your own cost agreement try in effect. In case your questioned payment contract is actually declined, the newest running of the collection several months try frozen for thirty days. The new financial advice your render can lead to a reduction, a rise, or no switch to the monthly payment amount.

Digital fee tips

Ahead of the payment package demand can be regarded as, you must be newest to your all the submitting and you may fee requirements. An internet fee arrangement is fast and it has a lower associate fee than the other application tips. Even when the Irs hasn’t yet , awarded your a costs, you may also establish a pre-assessed arrangement because of the going into the equilibrium you’ll owe from your own taxation return. To help you consult a long-label fee plan, make use of the On the internet Fee Arrangement application. Different types of enough time-label percentage agreements appear dependent on your position.

Simultaneously, taxpayers can be think other choices to possess percentage, in addition to bringing financing to pay extent due. Simultaneously, the taxpayers, regardless of money, are able to use Internal revenue service 100 percent free Document in order to electronically consult an automated tax-submitting extension. Personal taxpayers features multiple effortless ways to document Setting 4868 PDF by July 15 due date.